Taxes must be paid for household workers

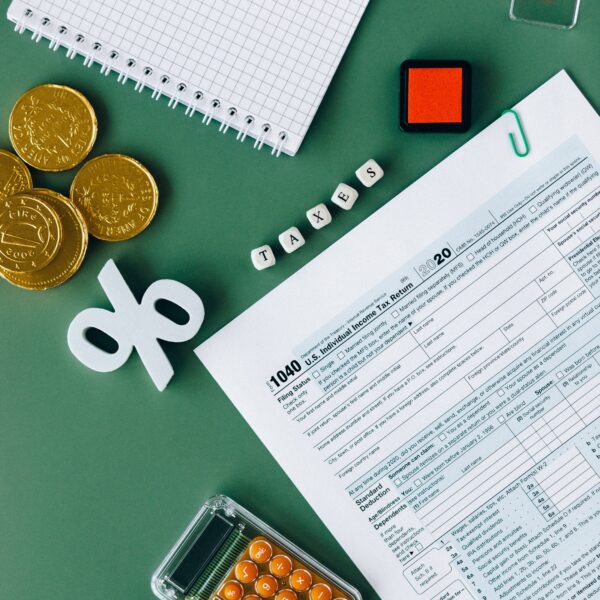

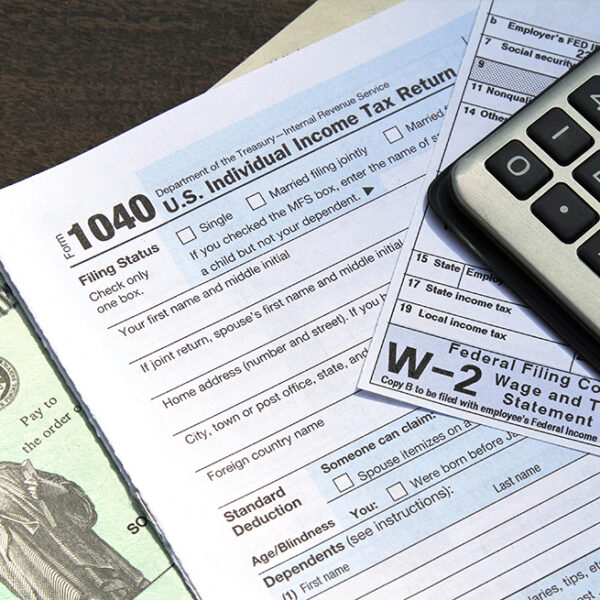

TAXES MUST BE PAID FOR HOUSEHOLD WORKERS If you employ a nanny, housekeeper, gardener, or other form of a household employee, you could be responsible for federal and state tax obligations. With the Household Employees Tax, you don’t need to withhold federal income taxes. Yet, you have the option to if the employee requests it and they fill out Form W-4. On the other hand, you may have to withhold Social … Read more