Navigating Business Formation: A Comprehensive Guide by CAPATA

Navigating Business Formation: A Comprehensive Guide by CAPATA Introducing a Guiding Light in Business Formation: CAPATA – Your Southern California Accounting Partner Step into a world of possibilities with CAPATA, a renowned name in Southern California’s financial landscape. As your trusted accounting ally, we are committed to helping you shape your entrepreneurial dreams into reality. At CAPATA, we recognize the pivotal role business formation plays in crafting your future success … Read more

Beyond Paperwork: CAPATA’s Approach to Business Location Filing and Compliance

Beyond Paperwork: CAPATA’s Approach to Business Location Filing and Compliance Discover CAPATA: Your Southern California Premier Accounting Firm Welcome to CAPATA, your premier Southern California accounting firm. As a trailblazer in the field, we understand that your aspirations drive your journey. Our role is not just to provide accounting services, but to empower you in building the future you envision. From navigating complex financial landscapes to ensuring seamless business operations, … Read more

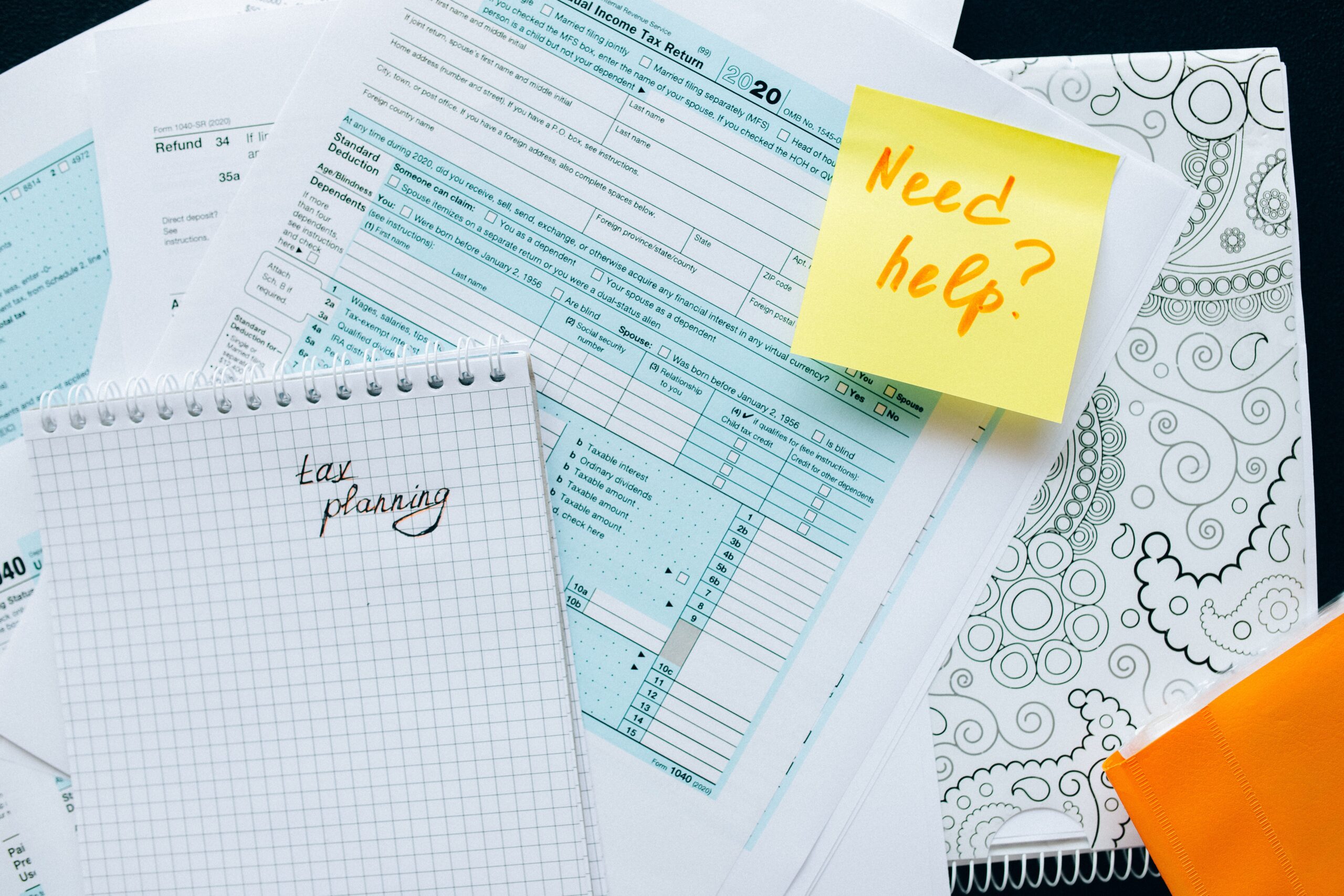

Maximizing Your Financial Potential: End of Year Tax Planning with CAPATA

Maximizing Your Financial Potential: End of Year Tax Planning with CAPATA As the year draws to a close, thoughts turn towards holiday celebrations, cozy evenings by the fire, and the promise of a fresh start. Amidst this festive atmosphere, there’s one more essential task that deserves your attention: end-of-year tax planning. In this comprehensive guide, we’ll delve into the intricacies of end-of-year tax planning and reveal how CAPATA, Southern California’s … Read more

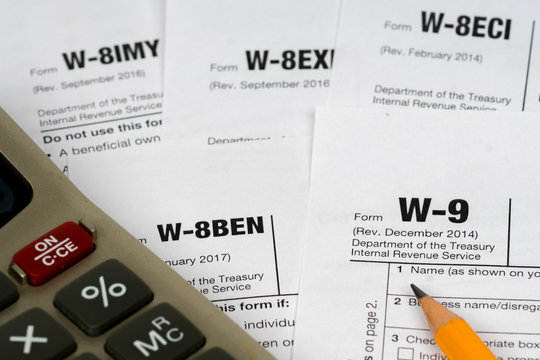

Navigating ERC Audits with CAPATA: Your Comprehensive Guide

Navigating ERC Audits with CAPATA: Your Comprehensive Guide In the dynamic landscape forged by the COVID-19 pandemic, the Employee Retention Credit (ERC) emerged as a financial haven for businesses navigating tumultuous waters. Crafted within the framework of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, this refundable tax credit emerged as a lifeline, empowering businesses to fortify their workforce in the face of economic uncertainty. Designed to aid entities … Read more

Mastering Your Finances: The Power of Quarterly Planning

Mastering Your Finances: The Power of Quarterly Planning Welcome to CAPATA: Your Premier Choice for Professional Accounting Services At CAPATA, we’re more than just accountants – we’re partners in your financial journey. As the finest accounting firm in Southern California, we understand that success is built on meticulous planning and strategic execution. That’s why we’re here to introduce you to the power of Quarterly Planning. Quarterly Planning isn’t just a … Read more

Maximizing Your Eligibility: Prepare for the ERC Pre-Audit with Confidence

Are you prepared to take control of your business’s financial future? The IRS has issued a notice for an ERC pre-audit, and the stakes are high. Don’t face this daunting task alone. CAPATA, the leading accounting firm in Southern California, is here to guide you through every step of the process. With our expertise and unwavering commitment to your success, we’ll help you navigate the complexities of the ERC pre-audit … Read more

Unmasking ERC Fraud: Protecting Your Future with CAPATA

Welcome to CAPATA, Southern California’s esteemed accounting firm dedicated to shaping a secure and prosperous future. Let’s explore the world of Employee Retention Credit (ERC) fraud and its profound impact on employees, employers, and business owners. Discover how CAPATA’s expertise can assist you in navigating the complexities of ERC and protecting your interests. ERC, a valuable tax credit supporting businesses during economic challenges, has unfortunately become vulnerable to fraudulent activities. … Read more

ERC Audit Defense: Protect Your Business with CAPATA’s Expert Accountants

Welcome to CAPATA, Southern California’s leading accounting firm dedicated to helping businesses navigate the complexities of ERC Audit Defense. Our team of expert accountants understands the importance of protecting your business’s interests and ensuring compliance with IRS regulations. With a deep commitment to your financial goals, we provide comprehensive services tailored to your specific needs. In this blog post, we will delve into the intricacies of ERC Audit Defense, guiding … Read more

Maximizing the Employee Retention Credit: Strategies for ERC Audit Defense

Welcome to CAPATA, the trusted ally that can guide you through the intricate terrain of defending audits on the Employee Retention Credit (ERC). As a leading accounting firm located in Southern California, we recognize the significance of preserving your business’s financial well-being while ensuring compliance with tax regulations. We will explore the complexities surrounding ERC audits, unveiling CAPATA’s expertise and demonstrating how our services can empower you to overcome any … Read more

From Burnout to Breakthrough: How CAPATA Helps Startups Optimize Cash Burn Rates for Sustainable Success

Welcome to the world of startups, where dreams take flight and innovation knows no bounds. Are you ready to dive into the captivating realm of cash burn rates? Look no further, for CAPATA, Southern California’s premier accounting firm, is here to be your guide on this thrilling financial journey. Imagine a future where your startup not only survives but thrives, where every decision you make is fueled by a deep … Read more

Building a Resilient Future: Harnessing the Strength of All Reserves

Welcome to CAPATA, Southern California’s premier accounting firm dedicated to helping businesses like yours achieve their financial goals. With a deep understanding of the importance of All Reserves in building a strong financial foundation, we are here to guide you through the intricacies of reserve management. We will explore the different types of All Reserves, highlight their significance, and demonstrate how they can positively impact your business. At CAPATA, we … Read more

Tax Deadline Extension Updates for Disaster Area Taxpayers

Disaster-area taxpayers in most of California now have until Oct. 16, 2023, to file various federal individual and business tax returns

The Inflation Reduction Act of 2022

The Inflation Reduction Act of 2022 The President recently signed into law the Inflation Reduction Act of 2022. This legislation will not only deal with Medicare’s drug price negotiations but will also deal with the ever-important climate change issue. Let’s look at what this legislation has to offer: Additional Funding for IRS Enforcement Over a ten-year period, funds are given to improve taxpayer services, enforce laws, support operations, and modernize … Read more

Changing Employees to Independent Contractors?

Changing Employees to Independent Contractors? What are the Ramifications? An employer made the decision to change the status of their workers from employees to independent contractors and it ended up backfiring. An at-home nursing service provider owed almost $1.3 million in back employment taxes and penalties for a misclassification of 99 nurses. The taxpayer, for reasons that were unclear, made the decision in 2016 to switch their employees to independent … Read more

New Tax Refund Bills!

NEW TAX RELIEF BILLS HAVE BEEN SIGNED INTO ACTION BY THE GOVERNOR! In addition to granting tax refunds of $700 to qualifying taxpayers with California AGI up to $250,000 ($500,000 HOH), this bill also authorizes up to $1,050 for MFJ taxpayers who have California AMI over $500,000. The only downside is the payments will not arrive until the end of October (at the earliest). www.ftb.ca.gov/about-ftb/newsroom/middle-class-tax-refund/middle-class-tax-refund.html#receive There are many things this … Read more

Tax Management in the Virtual World

TAX MANAGEMENT IN THE VIRTUAL WORLD Recently we have seen how cryptocurrency investments can be very unpredictable. In November 2021, the cryptocurrency market peaked at about $3 trillion. Two months later, the cryptocurrency market plummeted over 40%, wiping out more than $1.2 trillion in a matter of months. This can be daunting to navigate, but just like any bear or bull cycle in the stock market, it can present opportunities to use … Read more

Holding Property in a Corporation Cons

HOLDING PROPERTY IN A CORPORATION POTENTIAL ISSUES Holding property in an entity provides asset protection from creditors, but the type of entity holding the property will have a big tax impact; for example, partnerships have an edge over C or S corporations when it comes to getting the property back out of the entity. Weighing the pros and cons of different entities, whether real estate will be held in the … Read more

Employee Retention Tax Credit (ERC)

EMPLOYEE RETENTION TAX CREDIT As we approach tax season, the Employee Retention Credit (ERC) may be an important credit for businesses. The ERC is a fully refundable IRS payroll tax credit (not a loan) available to employers with the potential of up to $26,000 per employee in federal payroll taxes. Businesses that received round one and/or two of Paycheck Protection Program (PPP1 and PPP2) loans also qualify for the ERC. Benefits The … Read more

Paying the SALT Workaround Tax

THE LOGISTICS: PAYING THE SALT WORKAROUND TAX We previously sent you information about the details of the SALT cap work around, or Pass-Through Entity (PTET) on November 8, 2021. Here is a brief recap and a link to the full article: The Franchise Tax Board has now published the PTE Elective Tax Payment Voucher (FTB 3893) on November 1, 2021. The voucher may be used by S corporations and partnerships to … Read more

State Tax Deduction Workaround

STATE TAX DEDUCTION WORKAROUND This year California passed AB 150, which enacts an elective passthrough entity tax (PTET). The idea behind the PTET is to work around the $10,000 SALT deduction limit to an individual’s itemized deductions that came into effect back in 2018. Simply, qualified passthrough entities may pay tax on a consenting owner’s behalf based on the owner’s distributive share of income. The entity may then include that … Read more

Early Retirement

EARLY RETIREMENT? 10 STEPS TO GET YOU THERE! When it comes to retirement, there is always a thought in the back of your mind saying, “how can I get there earlier?” Though some plan for traditional retirement, there is a vast majority that would love nothing more than to retire early to fully enjoy their golden years. With the right planning, that goal is achievable. There are 10 steps you … Read more

Advance Child Tax Credit

ADVANCE CHILD TAX CREDIT INFORMATION: WHAT YOU NEED TO KNOW Advance Child Tax Credit: The IRS created a Child Tax Credit Update Portal, it is a password-protected tool available to everyone with internet access from any device. You may check on your eligibility, payment status, or unenroll from this benefit. If you have an existing IRS account, you may use the same login credentials. For 2021 only, taxpayers can claim half … Read more

Proposed Tax Relief Bills for California

Proposed Tax Relief Bills for California Proposed Tax Relief Bills: California’s Governor is expected to sign several tax-related and stimulus bills that the California General Assembly sent to him. SB 139 will authorize a second Golden State Stimulus payment up to $1,100 per California taxpayer with an AGI of $75,000 or less. How much qualifying taxpayers will receive is dependent on their income, immigration status, and if they have … Read more

Outsourcing Your CFO

Why Do So Many Businesses Use Outsourced CFO? There are many benefits to outsourcing the Chief Financial Officer (CFO) role, especially if you own a small business. An outsourced CFO ensures you are getting the same expertise from a CFO even if you may not have the financial resources to retain or support a full-time CFO. By outsourcing the CFO role, your business will be able to benefit … Read more

Preparing Your Business for Recessions

Preparing Your Business for Recessions Preparing Your Business for Recessions: We all know that recessions will come in a matter of time, and no business has immunity from an economic downturn as we have seen with the recent COVID-19 pandemic. As our economy begins to improve, here are six strategies you can implement into your business model or plan to maximize the likelihood of weathering future recessions.

California’s Partial PPP Conformity Bill

California’s Partial PPP Conformity Bill Partial PPP Conformity Bill: On April 29, 2021, Governor Newsom signed into law Assembly Bill No. 80 (“AB 80”). Providing partial conformity to the Federal tax treatment for deducting expenses. These are paid with Paycheck Protection Program (“PPP”) loans, EIDL advance, and targeted grants. Below are some of the key highlights of the bill’s provisions:

Deducting Meals and Entertainment Expenses

Deducting Meals and Entertainment Expenses Deducting Meals and Entertainment Expenses: While the Tax Cuts and Jobs Act (TCJA) of 2017 eliminated many deductions for business meals and entertainment. There are still some deductions available. Most of the deductions are in the form of business meals. There are select exceptions of when a business can also deduct entertainment expenses.

How to Handle a Self-Directed IRA

How to Handle a Self-Directed IRA Traditional and Roth IRAs are great tools to use for financial, estate, and retirement planning. One way individuals “turbocharge” their IRA’s performance is to use a self-directed IRA, which is able to hold alternative investments that offer potentially higher returns. Although this is a useful feature, there could be some tax-traps that have the ability to throw a wrench into your plans if your self-directed are not … Read more

California PPP Tax Conformity- Update

California PPP Tax Conformity- Update California PPP Tax Conformity: Although it is no secret that California has yet to release information on whether or not it will partially conform state tax code to the current federal tax rules regarding forgiven Paycheck Protection Program (PPP) loans, CalCPA has shared why the delay is taking place.

Individual Tax Deadline Extended

Individual Tax Deadline Extended to May 17, 2021 Individual Tax Deadline Extended: The Internal Revenue Service (IRS) and Treasury Department announced today the 2020 tax year federal income tax filing due date for individuals has been automatically extended from April 15, 2021 to May 17, 2021. Just like last year, taxpayers do not need to file additional forms for the May 17, 2021 deadline. Formal guidance will be coming from … Read more

Employee Retention Credit Webinar

Employee Retention Credit Webinar During the Employee Retention Credit Webinar, we covered the following topics: Overview of the ERC Program Determining Your Own Eligibility ERC Recap Tax Reporting Advanced Considerations Next Steps Q&A

American Rescue Plan Act 2021

AMERICAN RESCUE PLAN ACT 2021 How the ARPA Affects You The latest legislation providing economic and other relief from COVID-19 has passed Congress and President Biden is expected to sign it into law. The American Rescue Plan Act (ARPA) includes $1.9 trillion towards funding for state and local governments, businesses, and individuals. The ARPA is meant to expand and extend major provisions made in the CARES and Consolidated Appropriations Acts. … Read more

401(k) After Retirement or Changing Jobs

401(K) AFTER RETIREMENT OR CHANGING JOBS 401(k) After Retirement or Changing Jobs: If you plan to retire or change jobs soon, it’s very important to have a plan for your balance in your current employer’s 401(k) plan. You could keep your savings where it is, roll them over into and IRA, or transfer the balance over to your new employer’s 401(k) plan. You do not need to rush your decision … Read more

Employee Retention Credit

EMPLOYEE RETENTION CREDIT Employee Retention Credit: The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was an economic stimulus bill that was signed into law on March 27, 2020. One of the provisions of the CARES Act was the Employee Retention Credit. One that provides payroll tax credits available for employers. Which includes tax exempt organizations who retained employees during the COVID-19 pandemic. The goal is to help and … Read more

PPP2 Application Forms Released

PPP2 APPLICATION FORMS RELEASED PPP2 Application Forms Released: The new COVID-19 relief bill was signed into law on December 27, 2020. $284.5 billion became available to the second installment of the Paycheck Protection Program (PPP2) loans. $35 billion has been set aside specifically for those who are applying for a PPP loan for the first time. Another $15 billion has been reserved especially for community financial institutions (CFIs). First and … Read more

Year-end Tax Planning

Year-end Tax Planning With the year coming to a close, now is an important time to be thinking about ways to save on taxes for 2020 and possibly 2021. Year-end tax planning and projections are especially valuable this year as new guidance was released on the Tax Cuts and Jobs Act (TCJA) as well as the Families First Coronavirus Response Act and the Coronavirus Aide, Relief and Economic Security (CARES) … Read more

New Text Phishing Scam

New Text Phishing Scam The Security Summit (a partnership of the IRS, private sector, and state tax agencies) has released a warning. It was to taxpayers about a COVID-related New Text Phishing Scam. It deceives people into providing their bank information. The scam is generated by a text message claiming the person has received the $1,200 Economic Impact Payment (EIP). This is the text message that has been used: “You … Read more

Deferring Employee Payroll Taxes

Deferring Employee Payroll Taxes The U.S. Treasury and IRS have released the initial guidance, Notice 2020-25, to put into operation the President’s Executive Order, which allows deferring employee payroll taxes beginning on September 1, 2020. It’s important to note that this relief is intended for the employer, not the employee. The employer is the “affected taxpayer” in this Executive Order. Initial Guidelines This Executive Order is for employers who … Read more

PPP Interim Final Rule: Owner-Employee Compensation and Eligible Nonpayroll Costs

PPP Interim Final Rule: Owner-Employee Compensation and Eligible Nonpayroll Costs On Monday, August 24, 2020, the Small Business Administration (SBA) and U.S. Treasury released an interim final rule. It gave further guidance on the Payroll Protection Program (PPP) loan forgiveness for owner-employee compensation and eligible nonpayroll costs. The interim final rule states that owner-employees of C or S corporations. Those with less than a 5% stake are exempt from the … Read more

PPP Loan Forgiveness Updates – Live Webinar

PPP Loan Forgiveness Updates Webinar Come join our webinar to get more information on the PPP loan forgiveness updates. We will show you what the updated eligible expenses are, cover the new Paycheck Protection Flexibility Act, go through the new Interim Final Rule, and walk you through the rules for loan forgiveness. We want to give you the tools to succeed during this time. Topics PresentersSal Kureh, PartnerLeo Zhang, Staff … Read more

Paycheck Protection Program Reminder

Paycheck Protection Program Reminder Just as a reminder, the Paycheck Protection Program (PPP) Loan application deadline is today (June 30, 2020). With today being the last day to apply for a PPP loan, there is no more time to wait if you have decided that this program is the right thing to do for your business. You will need to have all of the required information before you go to a lender, so be sure to talk … Read more

Orange County Grant Small Business Relief Program

Orange County Grant Small Business Relief Program If your business is located in Fountain Valley, Newport Beach, Tustin, or Westminster, your city is administering the grants. You can get information on them at https://ociesmallbusiness.org/local-grant-and-loan-programs/ If your business is located in Orange County supervisorial district 4, which includes the cities of Brea, Fullerton, LaHabra, Placentia, most of Anaheim, part of Buena Park and unincorporated communities, you can get information athttps://ociesmallbusiness.org/ocdistrict4/ If your business is located in Orange County supervisorial district … Read more

Senate Passes Paycheck Protection Program Flexibility Act

Senate Passes Paycheck Protection Program Flexibility Act As expected, the Senate has passed the House of Representatives’ version of the Paycheck Protection Program (PPP) Flexibility Act on June 3, 2020.This legislation will remove many restrictions from the original PPP terms while still allowing businesses to maximize forgiveness. Key Provisions Some of these highlights are recaps of our previous email. Others have clarified the details of the Act. Below are the provisions that have … Read more

PPP Loan Forgiveness – Possible Loosened Restrictions

PPP Loan Forgiveness- Possible Loosened Restrictions The House of Representatives has passed the Paycheck Protection Program Flexibility Act to the Senate on May 28, 2020 with a 417-1 vote. The bill will make qualifying for PPP loan forgiveness easier for borrowers. This is done by loosening some of the restrictions originally put in place as part of the CARES Act on March 27, 2020. It is important to note that this bill is not a law at the … Read more

Orange County COVID-19 Layoff Aversion Support Fund Program

Orange County COVID-19 Layoff Aversion Support Fund Program In breaking news, the California Employment Development (EDD) funded $700,000 to Orange County’s Workforce Development Board (OCWDB) in partnership with the Orange County Community Services- Community Investment Division. These funds have been put into the COVID-19 Layoff Aversion Support Program to help small businesses within the Orange County area mitigate layoffs and follow federal and state health orders, such as “social distancing”. This program only has an application window … Read more

PPP Loan Forgiveness (Live Webinar)

PPP Loan Forgiveness Webinar The webinar is now over: If you happened to miss the webinar, we don’t want you to miss out on the valuable information about PPP Loan Forgiveness. You can now watch it at your convenience. Because of the amount of information regarding the PPP loans. We may not have had a chance to discuss everything in great detail. If you have any remaining questions, please feel … Read more

Extended Employee Benefit Plan Deadlines

Extended Employee Benefit Plan Deadlines When the IRS issued Notice 2020-23, they provided needed guidance for business owners as a result of the extended July 15, 2020 deadline to file and pay taxes. This Notice is specifically regarding the “specified actions” and filing obligations that are normally due on or after April 1, 2020, pushing these back to the July 15, 2020 deadline. The “specified actions” are any time-sensitive actions … Read more

PPP Loans – Bet Practice Guidelines

Paycheck Protection Plan (“PPP”) Loans – Disbursement and Use of Loan Funds – Best Practice Guidelines PPP Loans – Best Practice Guidelines: If you’ve been approved for the Paycheck Protection Program loan, you may have been wondering what are the best practices for receiving and using the funds and documenting the expenses the funds are used on. We have compiled some guidelines to help you as much as possible and we … Read more

Paycheck Protection Program

Let Us Help: Paycheck Protection Program If you’re like many business owners in the US today, you’re trying to get the most information possible about how to keep your business running. The CARES Act created new relief loans for small businesses called Paycheck Protection Program (PPP) loans. They are intended to encourage employers to keep their employees on their payroll, so there are huge benefits to these loans. Loan Forgiveness If you spend the … Read more

Employee Retention Credit

IRS: Employee Retention Credit available for many businesses financially impacted by COVID-19 WASHINGTON — The Treasury Department and the Internal Revenue Service today launched the Employee Retention Credit, designed to encourage businesses to keep employees on their payroll. The refundable tax credit is 50% of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19. Does my business qualify to receive the Employee Retention Credit? The … Read more

Scams and Phishing Attempts During COVID-19

Tax Update: Scams and Phishing Attempts During COVID-19 The IRS has released a statement urging taxpayers to remain extra vigilant for scams and phishing attempts during these uncertain times. With taxpayers receiving economic impact payments, it is expected that there will be a criminal effort to intercept these payments. Red Flags Here is a list of different schemes scammers may try when aiming to steal your payment: Special Warning for Retirees The IRS has stated that if you … Read more

We’re Here to Help

At CAPATA, our mission is to help you to Rise and Build a Better Future. With the uncertainty we all face, we want you to know the future is not hopeless—it is filled with opportunities for those who prepare for them. I am reminded of Nehemiah 2:17-19, which says: “Then I said to them, ‘You see the trouble we are in, how Jerusalem lies in ruins with its gates burned. Come, … Read more

Business Survival in the COVID-19 Era

Business Survival in the COVID-19 Era by Michael Kinsman, CPA, Ph.D. If you are like most of us in business, in a few short weeks you have gone from wondering how to make your business grow and be more profitable to planning for its survival. COVID-19 and the rules about social distancing and isolation from others as much as possible have changed your interactions with customers (your business may have been ordered to close its doors and most of your customers are staying … Read more

Congress Enacts CARES Act Providing COVID-19 Relief

Tax Update: Coronavirus Aid, Relief, and Economic Security (CARES) Act March 27, 2020 saw the biggest economic relief act put into place in the United States’ history. The $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act provides many individuals and businesses with tax and economic relief. Perhaps the most significant piece of the CARES Act is the availability. Small business Loans Small business interruption loans of up to $10 million would be … Read more

Coronavirus Stimulus Payments

Tax Update: Coronavirus Stimulus Payments The government has established a new relief stimulus package that is set to help U.S. citizens that have been affected by COVID-19. The White House is aiming to begin sending out checks within the next few weeks, but how much you are given is going to be determined by your most recently filed tax return or information from the Social Security Administration. You must have a Social Security Number (SSN) in order to receive a check. … Read more

People First Initiative Guidelines

Tax Update: IRS Provides More Guidelines for People First Initiative Yesterday, the IRS disclosed their guidelines to the People First Initiative. As a COVID-19 effort, several important adjustments have been made and compliance programs have been suspended. As of now, the Initiative will be in effect from April 1 to July 15. The IRS will continue to give more specifics in the near future, but they have released information regarding the highlights of the initiative. New … Read more

Tax Filing Extension FAQs

IRS ANSWERS QUESTIONS REGARDING EXTENSION RELIEF In FAQs just posted on their website, the IRS answered many of the questions regarding the July 15 filing and payment extension announced in IRS Notice 2020-18. Note the following highlights: The FAQs are available at: www.irs.gov/newsroom/filing-and-payment-deadlines-questions-and-answers Please contact us if you have any question.

Tax Filing Deadline Officially Extended

Update: Tax Filing Deadline Officially Extended This morning the Treasury Secretary Steven Mnuchin announced that the President Trump has approved pushing the April 15th tax deadline to July 15th. All tax filing and payments may now be completed by July 15th without penalty or interest. As of right now, the IRS has not issued any guidance on this matter but is expected to provide those details on Monday (3/23/2020). We will continue to update you as more information and guidelines become available. If … Read more

Families First Coronavirus Response Act

The Federal government continues to prod the economy by passing the “Families First Coronavirus Response Act” (the “Act”). Parts of the Act provide for emergency family and medical leave benefits, emergency paid sick leave benefits, and employer and self-employed tax credits and exclusion from employer FICA tax concerning the payment of those benefits. Employer tax credits The Act provides tax credits to employers to cover wages paid to employees while … Read more

COVID – 19

At CAPATA, our mission statement is that we help you to Rise to Build a Better Future. To do that in the current environment, we’re taking every precaution possible to protect the health and safety of our team and their families, given the ongoing COVID-19 Virus situation. Out of an abundance of caution, we are not taking any chances. For years, CAPATA has implemented flexible work arrangements for any Team Member desiring one. • We have communicated … Read more

Tax Deduction for Home Business

Do you Run Your Business from Home? You Might be Eligible for Home Office Deductions If you are self-employed and work out of an office in your home, you may be entitled to home office business tax deduction. However, you must satisfy strict rules. Eligible taxpayers can deduct the “direct expenses” of the home office such as the costs of home office repairs. This includes the costs of painting or … Read more

Do you Want to go Into Business for Yourself?

Do you Want to go Into Business for Yourself? There are many ways to conduct a business for tax purposes, including as an S corporation or a partnership. But many new ventures start out as sole proprietorships. Here are nine business tax rules and considerations involved in operating as that entity. Seek assistance If you want additional information regarding the business tax aspects of your new business, or if you … Read more

2020 Tax Limits Affecting Businesses

NUMEROUS TAX LIMITS AFFECTING BUSINESSES HAVE INCREASED FOR 2020 A variety of tax-related limits that affect businesses are annually indexed for inflation, and many have increased for 2020. How much can your employees contribute to 401(k) plans this year? How much do employees have to earn in 2020 before they can stop paying Social Security tax? Here are the answers to these and other questions about annual tax-related inflation adjustments affecting businesses. … Read more

You May be Eligible for Tax Credit if Your Employees Receive Tips

Do Your Employees Receive Tips? You May be Eligible for a Tax Credit Employers in the food and beverage industry may be eligible for a valuable tax break with the Social Security and Medicare (FICA) taxes tip credit. Here’s how it works. How the credit works The FICA credit applies with respect to tips that your employees receive from customers in connection with the provision of food or beverages, regardless … Read more

What Can AI do for my Business?

WHAT CAN AI DO FOR MY BUSINESS? No doubt you have heard stories about how artificial intelligence (AI) is bringing extensive changes to a wide variety of industries. It’s one thing to learn about how this remarkable technology is changing someone else’s company and quite another to apply it to your own. Artificial intelligence may seem capable of doing just about anything, but you’ve got to research your needs carefully … Read more

Cost Management: A Budget’s Best Friend

COST MANAGEMENT: A BUDGET’S BEST FRIEND Sometimes it may seem that escalating expenses always get the better of you. If your company comes up over budget year after year, you may want to consider cost management. This is a formalized, systematic review of operations and resources with the stated goal of reducing costs at every level and controlling them going forward. It can assist you in differentiating activities such as: … Read more

New Law Helps Businesses Make Their Employees’ Retirement Secure

NEW LAW HELPS BUSINESSES MAKE THEIR EMPLOYEES’ RETIREMENT SECURE The Setting Every Community Up for Retirement Enhancement Act (SECURE Act) was signed into law on December 20, 2019 as part of a larger spending bill. If your small business has a current plan for employees or if you are thinking about adding one, you should familiarize yourself with the new rules. Here are three provisions of interest to small businesses: … Read more

It May Not be Too Late to Cut Your 2019 Taxes

It May Not be Too Late to Cut Your 2019 Taxes Don’t let the holiday rush keep you from taking some important steps to reduce your 2019 tax liability. You still have time to implement a cut 2019 taxes strategy, including: Buying Assets Considering purchasing new or used heavy vehicles, heavy equipment, machinery or office equipment in the new year? Buy it and place it in service by December 31, … Read more

Important Things to Know About Refunds

GET READY FOR TAXES: IMPORTANT THINGS TO KNOW ABOUT REFUNDS WASHINGTON – As tax season draws near, the Internal Revenue Service (IRS) cautions taxpayers not to rely on receiving their refund by a certain date. Especially when making major purchases or paying bills. Refunds may take longer for tax returns that require additional review. Many factors affect refund timing Each tax return is unique and individual, therefore so is each … Read more

Bridging the Gap Between Budgeting and Risk Management

BRIDGING THE GAP BETWEEN BUDGETING AND RISK MANAGEMENT At many companies, there is a large disparity between the budgeting process and risk management. There are major threats that could leave you vulnerable to high-impact hits to your budget if one or more of these threats occur. We have listed some common types of risks to research, assess and include into adjustments as you draw up next year’s budget: Competitive. The … Read more

The Tax Implications if Your Business Engages in Environmental Cleanup

The Tax Implications if Your Business Engages in Environmental Cleanup If your company needs to “remediate” or clean up environmental contamination, the expenses involved can be environmental cleaning tax as ordinary and necessary business expenses.These expenses may include the actual cleanup costs, in addition to expenses for environmental studies, surveys and investigations, fees for consulting and environmental engineering, legal and professional fees, environmental “audit” and monitoring costs, and other expenses. … Read more

Reporting 1099-MISC Requirements

REPORTING 1099-MISC REQUIREMENTS Your business may be required to send 1099-MISC forms to nonemployees. Nonemployees such as independent contractors, vendors, etc. and to file these forms with the IRS. These forms are due a month after the new year starts and they take time to properly put together, so it’s beneficial to get the ball rolling early to eliminate the stress of filing on time and avoiding penalties. Due date … Read more

Avoiding the Payroll Tax Penalty

AVOIDING THE PAYROLL TAX PENALTY A grueling task for many small businesses is keeping up with payroll. Withholding the correct amount of taxes from your employees’ paychecks and paying them to the government on time is absolutely necessary. You can personally be charged with the Trust Fund Recovery Penalty (or the 100% penalty) if you willfully neglect to withhold and pay the payroll taxes due. The penalty is applied to … Read more

Ensuring Your Company’s Future With a Shadow Board

ENSURING YOUR COMPANY’S FUTURE WITH A SHADOW BOARD Due to the speed of changing markets, some of today’s modern companies have implemented what’s called a “shadow” board. A company improvement shadow board is comprised of nonexecutive, younger employees. They can have a greater input of changing trends and lifestyles and help executive boards keep up with the times. Different Generations As time progresses, more Millennials and even some of Generation Z have … Read more

Tax Implications When Converting Corporations

TAX IMPLICATIONS WHEN CONVERTING CORPORATIONS If you’re considering switching your C corporation into a S corporation, there are many things to think about. An S corporation could give you more tax advantages than a C corporation, but there are many tax implications that could negate the possible savings. Here are four of the most common issues business owners run into when converting their corporations. LIFO: If your C corporation uses … Read more

Update Your Business Plan, Especially the Financials

UPDATE YOUR BUSINESS PLAN, ESPECIALLY THE FINANCIALS Companies usually launch with a business plan but fail to keep it updated. There are six sections that generally comprise business plans: executive summary, business description, industry and marketing analysis, management description, implementation plan, and financials. All of these should be analyzed and evaluated annually, but, if nothing else, your financials need the most frequent updating. Projecting the Future Business plans are very … Read more

Considering a Merger or Acquisition?

CONSIDERING A MERGER OR ACQUISITION A company merger or acquisition can be a huge benefit to your own business. You could increase revenue, sales, products, and services in a very short amount of time that might take years otherwise. However, merging or acquiring a new company has significant risks that could potentiallycause your business to shut down. Before making the final decision, you should do a thorough evaluation of the … Read more

Health Savings Account For Your Company

HEALTH SAVINGS ACCOUNT FOR YOUR COMPANY Due to increasing employee health care benefit costs, your business should consider creating Health Savings Account (HSA) for your employees. HSAs allow eligible employees or the business to save money for medical expenses in a tax-advantaged way. Tax advantages could be in the form of: Eligibility If an employee is covered by a high deductible health plan, he or she is eligible for a … Read more

6 Fundamentals to Make Your Sales Thrive

6 FUNDAMENTALS TO MAKE YOUR SALES THRIVE Sales and marketing go hand-in-hand. If you don’t have a solid marketing plan, how will you increase sales? To ensure your company’s sales are thriving, consider implementing these six steps into your marketing plan. 1. Keep all your products and services at the forefront. Oftentimes, clients will get stuck on a few products or services that are supplied by a business. A goal … Read more

Be Proactive About an IRS Audit

BE PROACTIVE ABOUT AN IRS AUDIT One of the many goals business owners have is to avoid an IRS audit at all costs. However, audits happen less frequently than you may think. Audit rates are at a historical low, with only 0.6% of individuals being audited for the 2018 fiscal year. Although this is good news, there is no guarantee that your business won’t be picked for an audit. Businesses, … Read more

Keep Your Team in The Loop

KEEP YOUR TEAM IN THE LOOP As we get closer to the new year, many business owners are gearing up for a profitable 2020. A couple things that contribute to the next year’s success is analyzing the past year’s mistakes and team work. You can’t fully know where you’re going unless you know where you’ve been. Finding the flaws An important area to detect are the profit losses that are … Read more

Deducting Website Expenses

DEDUCTING WEBSITE EXPENSES If you’re having trouble deciding how to categorize your company’s website costs for tax purposes, you’re not alone. The IRS hasn’t given official guidance on deducting website expenses yet, so you can apply the guidance they currently have on other business costs to your website. Website Equipment The hardware that you need to create and maintain a website falls under depreciable equipment. If these assets are placed … Read more

Begin Your Strategic Planning Now

BEGIN YOUR STRATEGIC PLANNING NOW Business owners have a lot on their plate, and one thing that often slips through the cracks is strategic planning. This is an important task within a company. So stop and take the time to plan your goals for the upcoming year. You can start by evaluating the following areas. The company’s financials Your business’ financial statements will let you know what areas your company … Read more

Planning For Succession and Retirement

PLANNING FOR SUCCESSION AND RETIREMENT Success and Retirement Plan For Your Business: Business owners are in a unique position when it comes to retirement. Not only do they need to save up for the years ahead. They also have to create the building blocks for a succession plan. Although it may be tricky, you can put both wheels into motion by deciding on these things: The date you want to retire. … Read more

Q4 2019 tax deadlines for businesses and employers

Q4 2019 TAX DEADLINES FOR BUSINESSES AND EMPLOYERS For the fourth quarter of 2019, here are four dates to keep in mind if you own a business or if you are an employer. This is not an all-inclusive list, so you can contact us to see what deadlines and filing requirements apply to your situation. October 15 • If you have a C corporation that filed a six-month extension, you must:– File … Read more

Choosing The Right Retirement Plan For Your Business

Choosing The Right Retirement Plan For Your Business Setting up a retirement plan for you and your employees is important when you have your own business or are involved in a start-up. There are several kinds of plans that have tax advantages and listed below are the three most commonly used. 401(k) A 401(k) plan is one of the most popular retirement options. It allows the employee to dictate how … Read more

Company Car Tax Benefits

COMPANY CAR TAX BENEFITS The use of company cars has long been a great fringe benefit for owners and employees of small businesses, and it has gotten even better with the recent tax law changes and updated IRS rules. Not only will the employer receive tax deductions, the owners and employees driving the vehicles will also receive tax breaks. The basics If you’re the owner or employee of a business … Read more

Receiving a “no-match” letter

Receiving a “no-match” letter Beginning in the spring of 2019, the Social Security Administration (SSA) began sending businesses and employers “no-match” letters. The no-match letter from social security are meant to warn employers. This is when there is a disparity between the SSA’s records and reported W-2 forms regarding the employee’s name and Social Security number (SSN). The letters inform employers that corrections are needed for the SSA to “properly … Read more

Rethink transferring funds due to the “kiddie tax”

RETHINK TRANSFERRING FUNDS DUE TO THE “KIDDIE TAX” The ”kiddie tax” was first enacted by Congress as a means to keep parents or grandparents in high tax brackets from shielding their income. They did this by giving it to children within their family in lower tax brackets. Although this tax was a bit of a headache for some in prior years. It has since evolved due to the Tax Cuts and … Read more

Taxes must be paid for household workers

TAXES MUST BE PAID FOR HOUSEHOLD WORKERS If you employ a nanny, housekeeper, gardener, or other form of a household employee, you could be responsible for federal and state tax obligations. With the Household Employees Tax, you don’t need to withhold federal income taxes. Yet, you have the option to if the employee requests it and they fill out Form W-4. On the other hand, you may have to withhold Social … Read more

Tax Deductions For Your Business

TAX DEDUCTIONS FOR YOUR BUSINESS Business have long relied on Section 179 to allow them to claim tax deductions for certain assets, rather than having depreciation deductions taken over time. Beginning in the 2019 tax year, Section 179 has been expanded by the Tax Cuts and Jobs Act (TCJA). Under the TCJA, the 100% bonus depreciation will also enable businesses to completely write-off qualified assets, such as property or equipment, that … Read more

Taxes Affecting Your Retirement

TAXES AFFECTING YOUR RETIREMENT Over the span of your working days, Social Security taxes are withheld from your salary or self-employment tax. Many people are surprised to find out that their Social Security benefits may be taxed once they retire. The amount you could be paying depends on your other forms of income. If you fall within a certain tax bracket, you will be required to include 50% to 85% … Read more

Q3 Key Tax Deadlines for Business and Employers

Q3 Key Tax Deadlines for Business and Employers As the third quarter of 2019 is upon us, here are some important tax-associated deadlines for businesses and employers. Be aware that this list is generalized, so you will have to do some research to find out if any other deadlines are applicable to you. If you need assistance, you can contact us to learn about your situation’s filing requirements and crucial dates. July … Read more

Tax Reform in Action

TAX REFORM IN ACTION Now that we have completed our first tax season of the year and got to see the Tax Cuts and Jobs Act (TCJA) in action. Its time to look at some key highlights of the tax reform to be aware of. Estimated Tax Penalty Relief There is good news for self-employed taxpayers. The IRS announced that it is waiving the estimated tax penalty for many taxpayers whose 2018 federal income … Read more

Retiring and moving to another state? Know about possible taxes

When many retire, they want to move to another state for multiple reasons. Before you move, you should be knowledgeable about the state and local taxes of the state/town you’d like to reside in. However, establishing residency for tax purposes might not be as simple as you think. Finding which taxes are relevant A big motivation for moving to another state may be no personal income tax. However, many states … Read more

Be prepared for an IRS audit

BE PREPARED FOR AN IRS AUDIT The 2018 (fiscal year) audit statistics were recently released by the IRS. It showed that fewer taxpayers had their returns examined compared to prior years. However, this will be of little consolation if you are one of the few that are chosen for an audit. Understanding how and why an audit is conducted may better prepare you. IRS audit statistics Only 0.59% of individual … Read more

Tax Implications of Selling Your Home

TAX IMPLICATIONS OF SELLING YOUR HOME Selling Home Tax: The best seasons for selling a home are spring and summer. With spring in the air and summer right around the corner, buyers may be out in full force in your area. An added bonus for buyers is the current interest rates. The average 30-year fixed mortgage rate was 4.3% during the week of May 2, 2019. This is while the … Read more

Hiring Your Children May Save You on Taxes

HIRING YOUR CHILDREN MAY SAVE YOU ON TAXES If you are a business owner, there are tax breaks and some nontax benefits when hiring your children. Hire your children to save on taxes, the benefits are all around. Kids can obtain valuable life experience while at the same time, learning how to manage money and save for college. The benefits you could receive are the ability to: It must be … Read more

Save Tax with an Electric Vehicle

If you’ve recently bought an electric or hybrid vehicle, you could be eligible for a federal income tax credit of up to $7,500. There might be additional state tax breaks and other incentives available to you depending on where you live. However, the tax break is subject to a complex phaseout rule based on sales made by a given manufacturer. The phaseout may reduce or eliminate the tax credit. Vehicles … Read more

How business owners must treat start-up expenses

If you recently established a new business, or you are contemplating starting one, you are now in a hectic, exciting time. Generally, with startup costs, one must spend a lot of money before opening their business. Expenses often go towards training workers, paying for rent, utilities, marketing and more. What first-time business owners often don’t know is that many expenses cannot be deducted right away. The way you handle some of … Read more